HOOD Hits All-Time Low at $9.40 as Plan for 300+ Layoffs Ends Hyper-Growth Story

Ahead of its earnings report, Robinhood (HOOD) is firing 9% of its full-time employers. Robinhood CEO Vlad Tenev announced this move on Tuesday in a blog post.

Considering that the brokerage platform accounted for 3,400 employees in January, when it set a plan for the majority of them to work remotely, the layoffs would affect around 300 people.

Robinhood Stock Plunges After Layoffs Announced by Blog Post

For those who have been paying attention, this is not surprising. Last October, JPMorgan hinted that Robinhood’s userbase decline could mean a 20% stock drop. Since that forecast, HOOD did not drop by 20%, but by 77%.

Indeed, Robinhood’s monthly active users (MAUs) dropped from Q2 2021’s 21.3 million to Q4 2021’s 17.3 million. It is for this reason that the brokerage announced plans to enable 24/7 trading in the future, after extending the trading window by four hours last month. Therefore, the remaining users with an average account size of $3,500 would have more opportunities to trade.

However, soon after that announcement, Goldman Sachs downgraded Robinhood to a “sell” rating. The reasoning behind the rating shift from “neutral” was the expectation that retail traders will be less engaged in the stock market.

“As the benefits of stimulus wane and the impacts of higher gas prices and inflation work through the economy, we believe HOOD could continue to see higher levels of churn as these investors leverage their smaller dollar account sizes for everyday spend,”

Goldman Sachs’ William Nance

Nonetheless, Robinhood frames the layoffs as necessary restructuring due to the accumulation of duplicate jobs in the last two years of “hyper-growth”.

“This rapid headcount growth has led to some duplicate roles and job functions, and more layers and complexity than are optimal.”

Robinhood CEO Vlad Tenev in company’s blog post

Join our Telegram group and never miss a breaking digital asset story.

Robinhood’s Rise and Fall Explained

In the blog post, Tenev noted Robinhood’s hyper-growth started in 2020, marked by the C19 event. Specifically, controversial government lockdowns reduced the range of available options for usual activities. Both FinTech and crypto platforms experienced massive growth in that time period.

For instance, the stablecoin market alone grew by 2,290%, from $7.78 billion in April 2020 to the present $186 billion. By the same token, Robinhood’s revenue expanded by 547%, from 2019’s $278 million to 2021’s $1.8 billion.

In the aftermath of January 2021’s short squeeze, Robinhood suffered a big reputational hit. Its “democratize finance” moto was turned upside down amid restricting stock trading for GameStop, AMC, and other stocks. Robinhood’s pay-for-order flow (PFOF) was especially controversial.

At one point last August, the HOOD stock dropped by 7% at a hint that SEC Chair Gary Gensler may ban the practice. However, these draining factors pale in comparison to the current macro-environment. With inflation at its highest level in 40 years, and the Fed ramping up interest rate hikes, it appears that the era of cheap credit is over.

Consequently, the stock market has been undergoing several selloffs since the start of the year.

To make financial affairs worse, the average US retail gas price is at $4.2 per gallon, a 43% increase from one year ago. Suffice to say, the combined consumer product/gas price hike is not accompanied by an appropriate wage hike. According to a Capital One Insights Center report, only 18% of respondents considered their wages in lockstep with the higher cost of living, across all income brackets.

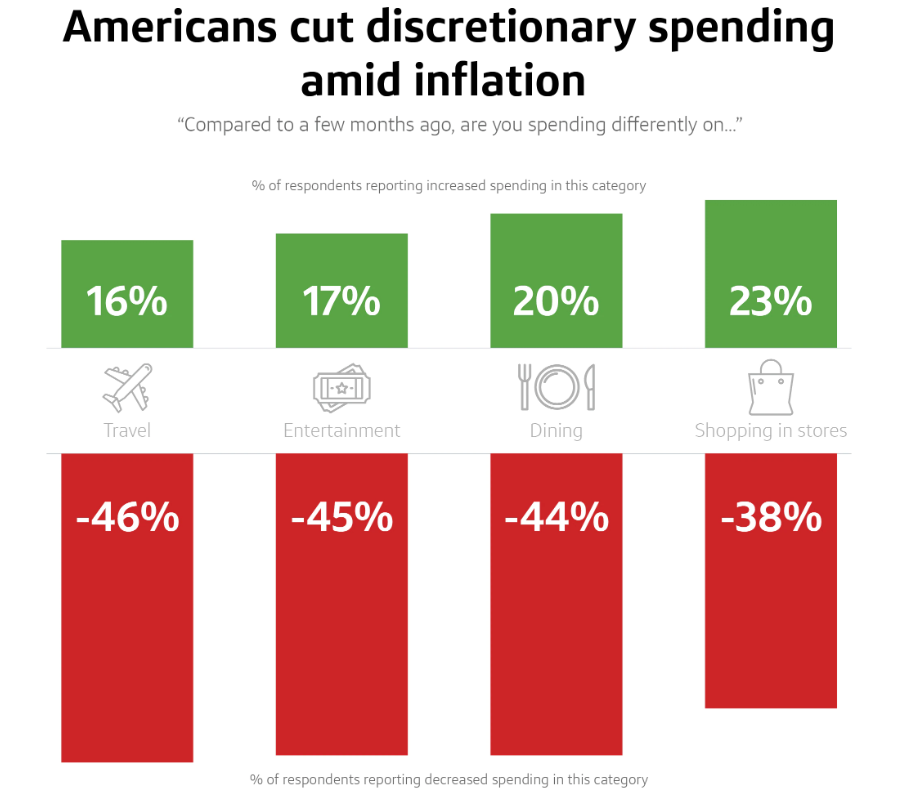

In turn, this is manifested in discretionary spending cuts, no longer supported by stimulus checks.

Given the fact that Robinhood’s retail accounts are on the lower end of the size spectrum, at $3,500, HOOD will likely further fall into the discretionary spending section.

Do you think Robinhood could recover back in the near future? Let us know in the comments below.

Update (28th April 2022): Fixed typo from “Lay Offs” to “layoffs”