Bitcoin is Booming — What Does it Mean for DeFi?

The cryptocurrency market is changing tack as we approach the end of the year. Historically a momentous time for the markets, the trend appears to be in Bitcoin’s direction again. Simultaneously, the DeFi market, a darling of investors in 2020, has seen a noticeable drop in interest.

Has the market migrated to its biggest asset as investors weigh the consequences of the US election? Or are investors simply expecting a rally to the previous all-time of $20,000? If it’s the latter, what does this bode for DeFi?

Bitcoin Gains Amid DeFi’s Drop

DeFi is unquestionably the biggest talking point of the market in 2020, but it has been swept aside by Bitcoin. Some investors may be wondering whether this is a result of a flagging DeFi space or Bitcoin’s own strengths. It is likely a combination of both.

Bitcoin has enthralled investors with its quick rally in the past few weeks. The $12,000 barrier looks like a done deal. As does the $13,000 mark, which now looks less like a resistance level and more of a support level. What remains is the $14,000 mark, the crossing of which could potentially signify a push toward $20,000.

eToro released a sentiment report on major assets recently, and Bitcoin scored among the highest. The news of major companies investing in Bitcoin and the expectation that the year’s end will bring strong price growth has attracted increased investment.

It appears the hope is that Bitcoin will reach or perhaps surpass the all-time high of $20,000. Market infrastructure and institutional investment have both improved, as has the general appeal of some cryptocurrencies.

2021 could very well be a year of Bitcoin, while banks bring their own firepower in the form of CBDCs. The notable increase in CBDC interest suggests that financial institutions very much consider cryptocurrency to be a threat. With worrying inflation and economic uncertainty, investors are also taking to Bitcoin for its hedging potential.

DeFi Metrics

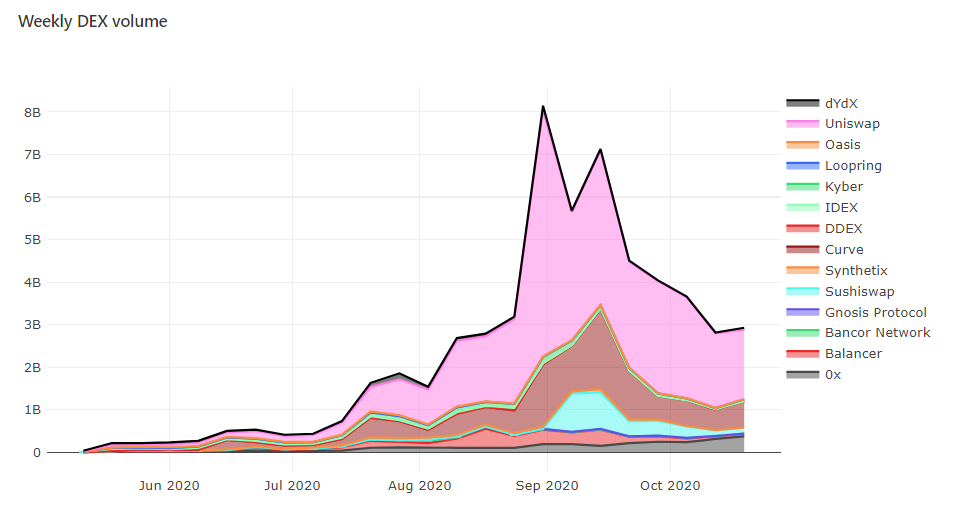

Meanwhile, DeFi has lost its sparkle by most quantifiable measures. It’s clear that investors no longer expect the wild price rises of preceding months.

October 2020 saw the first time in seven months that Bitcoin broke away from its pattern of growth. The DeFi Pulse Index dropped by roughly 34% over the past 30 days. And generally speaking, the social enthusiasm for DeFi seems to have died down.

In truth, the level of growth experienced so far could never have been sustainable. So perhaps it’s all for the best that the niche is now past its mania. With this out of the way, development teams can focus on globally viable solutions. Does DeFi remain a strong prospect when looking to the future, however?

DeFi’s Future in a Bitcoin Bull Run

The question on investors’ minds will be whether this comparatively low period of DeFi will be temporary or long-lasting. The smart investor will know better to put all their eggs in one basket.

One certainty is that most traders have realized that the high yields previously present in DeFi is unsustainable. Many have also cashed out their earnings, further dropping prices more. New protocols that arrive are scrutinized intensely, following the exploits and hacks that have occurred.

In short, like the 2017 ICO mania, DeFi is passing this phase. But that does not mean that this niche is going to fade away. In fact, as some have suggested, this is only the beginning of an age where decentralized finance goes mainstream.

Let’s not forget that there’s over $1 billion Bitcoin in DeFi. Its own growth is nothing but a positive sign for the market, if anything.

Investors are flocking to the bedrock of the market, from which all other tokens see their influx of funds. It is ‘digital gold’, after all. The growth of the market, in general, is good for the growth of DeFi, even if it is temporarily experiencing a lull.

Final Thoughts

There is little need to be worried about the DeFi space, which appears to be going through a period of maturity. Investors will not see the wild price rises of this year, but they will have the opportunity to invest in a mainstay of the market.

💡 Did you know: You can now buy Bitcoin and other cryptocurrencies with the leading stock market apps.

What do you think of the DeFi market’s slowing of growth? What do you expect of Bitcoin by the end of the year? Let us know in the comments below.