After Making $156M with Delayed SEC Filing, Elon Musk Wants Twitter’s HQ to be a Homeless Shelter

Elon Musk has been turning heads with his controversial tweets ever since it was revealed that the billionaire has purchased a 9.2% stake in Twitter, becoming the largest shareholder of the microblogging platform. While last week, Twitter’s former CEO Jack Dorsey and current CEO Parag Agarwal were “excited” to appoint Musk to the board, the “business magnet” surprisingly declined the invitation.

Elon Musk Will Not Join Twitter’s Board

In a major reversal, Musk has decided not to join the Twitter board, CEO Parag Agrawal said on Monday. Musk’s appointment was due to become effective on Saturday, but ostensibly the decision was reversed after Musk declined to join the board.

Agrawal said Twitter offered Musk a seat since the firm believed it was “the best path forward”, but noted that board members have to “act in the best interests of the company and all our shareholders”. Addressing Musk’s decision, Twitter CEO said, “I believe this is for the best”.

Some argue that the move was expected since Musk wouldn’t have been able to purchase more than 14.9% of Twitter shares after joining the company’s board.

Elon Musk Polls if Twitter San Francisco HQ Should be Turned into a Homeless Shelter

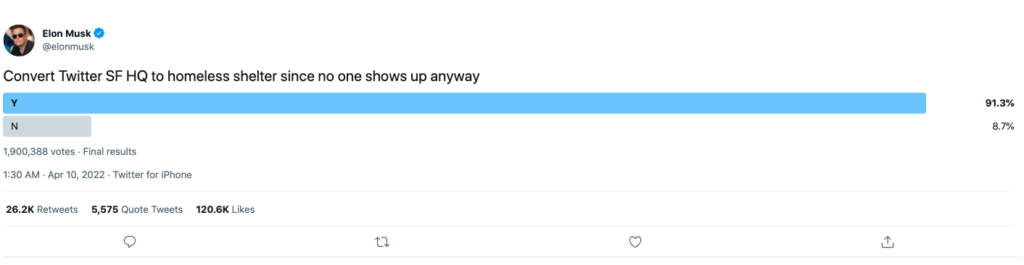

Meanwhile, over the weekend, Musk asked his more than $80 million Twitter followers whether Twitter should turn its headquarters in San Francisco into a homeless shelter. More than 90% of respondents supported the move, including Amazon founder Jeff Bezos.

The Tesla CEO also suggested Twitter give authentication checkmarks to all Twitter Blue users. “Everyone who signs up for Twitter Blue (ie pays $3/month) should get an authentication checkmark,” he said, even considering the idea of making it possible for users to pay for the Twitter Blue subscription using Dogecoin.

“And no ads,” Musk said in another tweet, suggesting that Twitter should stop depending on advertising money. “The power of corporations to dictate policy is greatly enhanced if Twitter depends on advertising money to survive,” he added. Notably, he has since deleted the majority of his tweets regarding Twitter.

Join our Telegram group and never miss a breaking digital asset story.

Musk Potentially Profited $156 Million with Delayed SEC Filing for Twitter Stock Purchase

US securities law requires investors to notify the SEC when they acquire more than a 5% stake in a company. Musk reached this threshold when he purchased 9.2% of Twitter shares. However, he delayed the form by 11 days, potentially earning $156 million, according to several legal experts who talked to The Washington Post.

That is because Twitter shares surged around 30% on the day Musk disclosed his stake in the company. More specifically, Twitter shares surged to over $50 after Musk’s disclosure. However, the billionaire had resumed acquiring Twitter shares before the disclosure, purchasing at the price of around $39 per share.

This means that Musk is in trouble as the SEC could slap the billionaire with a fine. However, experts believe a fine would be limited to hundreds of thousands of dollars, which is nominal compared to Musk’s profit of more than $150 million.

Nevertheless, Musk’s violation of securities laws could also “highlight the way billionaires and powerful individuals can skirt federal rules and even tax code to continue to build their wealth,” The Washington Post said.

It is worth noting that Musk and the SEC are currently in a battle over one of Musk’s tweets from 2018. At the time, the billionaire tweeted that he had secured funding to take Tesla private at $420 a share. Moreover, the SEC subpoenaed Tesla in November after Elon Musk asked his Twitter followers if he should sell 10% of his stake in the electric vehicle company.

Meanwhile, Twitter shares fell in premarket trading following the news. At one point, the company’s stock tumbled by as much as 8% to less than $43 per share. However, the company has since pared some losses and is currently trading at $46 per share, down by 3.5% in premarket.

Update (12th April 2022): Added screenshot of the deleted tweet.

Do you think Musk plans to acquire more Twitter shares? Let us know in the comments below.