3 Stocks Under $1 With Big Potential in December 2020

Penny stocks are a dime a dozen, but a good investor will stick to a few high potential ones. The same basic principles of value investing apply to these companies as well.

Picking the right stock is the challenging part. It can be difficult enough with the more general stock market, so added caution is required with penny stocks. To help, we’re listing some of the top penny stocks for the month of December.

3 Stocks Under $1 Worth a Closer Look

It can be tough to find the right stock, even when using the top brokers for investing in penny stocks. All of the companies listed below have their shares at below $1.

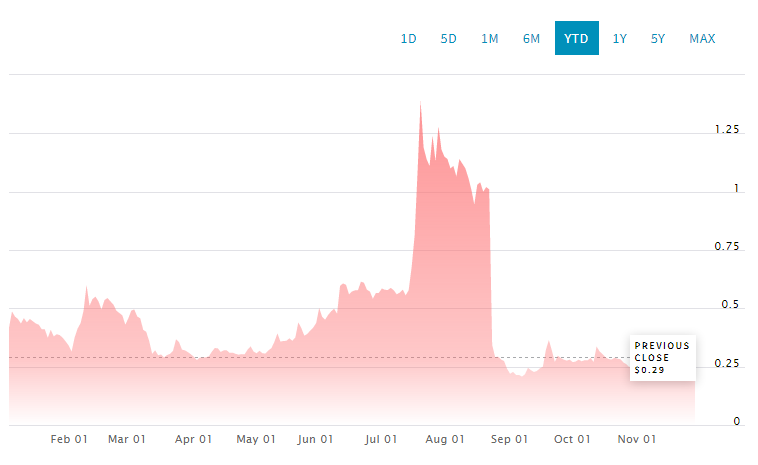

1. Advaxis, Inc. (NASDAQ:ADXS)

Advaxis is a clinical-stage biotechnology company that develops and commercializes immunotherapy antigen delivery products. Treatments focus on a variety of cancers, including cervical and various HPV-associated cancers.

At $0.30, Advaxis is an affordable buy, far from its 2020 high of roughly $1.30. The company’s commercial cancer therapy, that’s off-the-shelf, is one of its key products. The potential in Advaxis’ innovative solutions is likely why three hedge funds included the stock in its portfolio by the end of Q3 2020.

- The company announced the closure of its $9.2 million public offering in late November 2020.

- Funds raised from the offering will be used to continue research and development in the current product pipeline.

- It also has nearly 70 issued and pending patents.

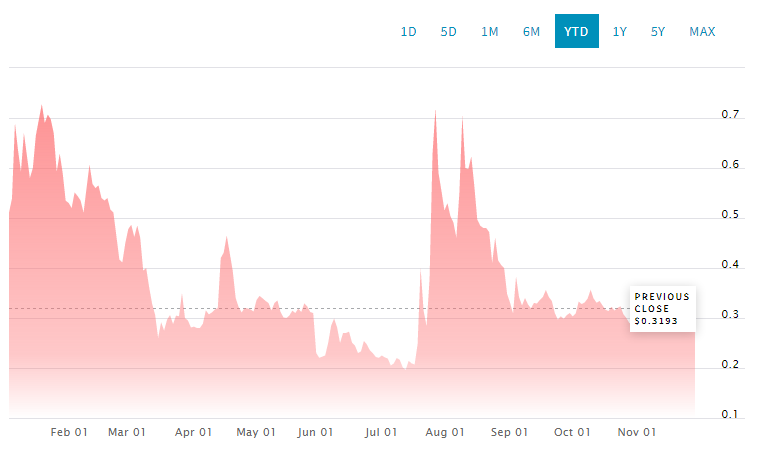

2. Onconova Therapeutics, Inc. (NASDAQ:ONTX)

Like Advaxis, Onconova Therapeutics is another biopharmaceutical company that researches and develops products for cancer treatment. It also has a proprietary system for this purpose, and a few of its newer treatments are nearing completion.

The stock price is currently hovering at around $0.29, down from its July highs of over $1. The shares could have tanked because one of its cancer studies fell through. However, the stock has done better in recent weeks.

- US Phase 1 trial for a new drug will start in 2021.

- Cash and cash equivalents stand at $24.2 million, up $1.5 million from December 21, 2019.

- Net loss for the Q3 2020 was $6.2 million, up from $4.6 million from the same time last year.

3. Ocugen, Inc. (NASDAQ:OCGN)

Focused on building transformative therapies to cure blindness, Ocugen has a breakthrough gene therapy platform. This solution can reportedly remedy multiple retinal diseases with one drug.

Chairman, CEO, and Co-Founder of Ocugen, Dr. Shankar Musunuri, has been part of several events, talking up the treatments. As for financial figures, Q3 2020 has seen the company post better results, recovering from a weaker first two quarters.

- Ocugen made aggregate prepayments of $4.5 million on unsecured notes, with no outstanding payments remaining.

- It sold a total of 27 million shares of common stock, raising net proceeds of $10.1 million.

- Cash, cash equivalents, and restricted cash totaled $19.3 million as of September 30, 2020.

Conclusion

A potential investor’s focus should be on evaluating stocks based on its innate value, i.e., carry out fundamental analysis. Penny stocks can be more volatile than other stocks, bringing higher risks and higher rewards. Due diligence is what matters most here.

It’s worth considering penny stocks as a tertiary part of your portfolio. There are other types of stock as well, such as growth stocks, which also have a unique value. Having a diversified portfolio is a good financial practice, penny stocks or not.

What do you think of these penny stocks? Do they stand to offer good returns? Let us know what you think in the comments below.

Disclosure: Tim Fries has no positions in any of the stocks mentioned, and has no plans to initiate any positions within the 72 hours following the publishing of this article. This article expresses the opinions of Tim Fries. Tokenist Media LLC has no position in any of the stocks mentioned, and does not plan to initiate any positions within 72 hours of the publishing of this article. Please consult our website policy for more information.