Holding Tesla Stock? Key Expectations Ahead of the Q3 Earnings

On Wednesday, Tesla (NYSE: TSLA) is scheduled to deliver its Q3 2024 earnings after market close (Q&A at 4:30 p.m. Central Time (5:30 p.m. Eastern Time)). Throughout the year, Tesla failed to exceed earnings per share estimates, with the last one in Q2 having delivered a negative 8.7% surprise at $0.42 reported vs $0.46 EPS estimated.

For Q3, analysts expect the same EPS forecast at $0.46, based on 9 analyst inputs per Zacks Investment Research. In the same quarter last year, Tesla delivered $0.53 EPS, which means that Tesla would have to deliver a 26% positive surprise to both beat the Q3 forecast and exceed the year-ago’s performance.

On a quarterly basis, Tesla would have to improve by at least 9.5% from last quarter’s $0.42 EPS. Year-to-date, TSLA stock is down 12.5%. However, after the Biden admin quadrupled tariffs on Chinese EVs mid-May, TSLA stock is up 28%.

Should investors expect further upside move or be prepared to buy the dip?

Robotaxi Event Follow-up

The much hyped robotaxi event on October 10th served as a balloon popping event. Tesla stock went down 9.5%, from $238.77 to present $216.14 per share. The stakes were exceedingly high, as Cybercab was supposed to demonstrate Tesla’s inevitable shift to full-self driving (FSD).

In turn, Tesla would no longer be just a luxury EV company, but one that has recurring cash flows from the robotaxi service. Such a transition would propel TSLA valuation to the roof. Elon Musk nailed it to around $5 trillion market cap, which would be 624% up from the present market cap of $690.5 billion.

However, the robotaxi rollout is mired by multiple uncertainties which the “We, Robot” event failed to alleviate. The controlled environment of the Warner Bros. studio still doesn’t demonstrate robust FSD capability, nor is there regulatory framework that would approve it.

If anything, the outcome of presidential elections could hobble Tesla’s robotaxi rollout efforts, judging by the existing level of lawfare against Elon Musk’s holdings.

The lawfare against @elonmusk, as gleefully described by the New York Times: pic.twitter.com/jPLtLyaYaK

— Stephen Pimentel (@StephenPiment) October 21, 2024

Hinting at more technical issues with Tesla’s FSD, CNEVPOST recently reported more delays for FSD launch in China, beyond the expected Q1 2025. Moreover, even if both conditions are satisfied – FSD and regulatory approval – Tesla would have to make the vehicle affordable as the primary requirement.

Overall, Deutsche Bank’s analysts summed up many impressions of the robotaxi event as “generally came away underwhelmed by the lack of details.”

Tesla’s Effort to Bring Down Costs Cuts Into Profitability

To step ahead of the competition, the bar is not that high for Tesla. Alphabet’s Waymo autonomous vehicles are even more luxurious, at a minimum cost of $150,000. As of August, Waymo revealed the development of 6th-generation hardware, which is supposed to offer “more capabilities at a fraction of the cost”.

That significant cost reduction is likely down to the $30k range. In May, China’s equivalent to Alphabet, Baidu, announced its own 6th-gen robotaxi Apollo RT6 at $28k. This is 60% lower than its predecessor Apollo Moon.

At Tesla’s robotaxi event, there was no mention of the anticipated “Model 2” which is rumored to be within the $25k to $30k range. For mass robotaxi production into 2027, by Elon Musk’s estimate, Model 2 is supposed to serve as the chassis foundation.

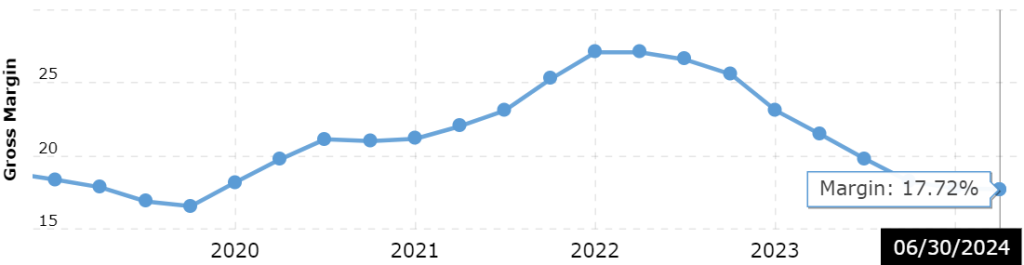

However, even accounting for tariffs against Chinese EVs, Tesla would have to keep low-margins to stay competitive against EV makers like BYD. Since Q1 2020, Tesla’s gross margin was on the upward trajectory only to start reverting by the end of 2022.

According to FactSet, analyst consensus points to just a slight gross margin improvement (for auto), at 14.7% vs 14.6% in Q2.

Analyst Expectations for Tesla Stock

On Monday, Wedbush Securities analyst Dan Ives noted that Musk’s outlook for Q4 and 2025 will likely play a bigger role than Q3 figures themselves. For the upcoming quarter, Ives expects “some slight upside likely on the margins front showing a bottoming on this key metric.”

In Q3’s deliveries report, Tesla managed to improve upon the year-ago quarter at 462,890 vs 435,059 EVs respectively. Although that was slightly above the expected 461,000 deliveries, it is clear that TSLA shareholders have grown to expect more.

In other words, it is fair to say that years of delays and lackluster profit margins have elevated investor expectations. This is why Q3 results would have to be exceptional to move TSLA stock significantly upward, but that is unlikely when accounting for all the aforementioned factors.

According to WSJ’s analyst ratings, the average TSLA price target is $216.25, aligning with the current price of $216.14 per share. Nasdaq’s aggregated median based on 32 analysts is even lower, at $209.48 per share.

Do you think the West should allow China to offer affordable EVs? Let us know in the comments below.

Disclaimer: The author does not hold or have a position in any securities discussed in the article.