Dividend Investing in an Altcoin Era: Complementary or Redundant?

Younger investors find themselves in a dilemma. The new blockchain domain of cryptocurrencies offers easy access to capital and rapid valuation cycles that are inherently speculative and high in profit potential.

On the other hand, traditional dividend investing is ideal when starting young. If exposed to reliable dividend-paying companies, the risk is minimized while the returns are consistent. Should investors pick one over the other or find a middle ground?

Why Dividend Investing is a No-Brainer

For a company to even entertain dividend payouts to shareholders, its earnings must be sufficiently consistent with plenty of cash reserves allotted for expansion. This starting position provides a cushion for investing exposure because such companies have intrinsic value.

Something that cannot be said of memecoins that rely on hype-driven speculation and can be created ex nihilo. Moreover, dividend investing is at the top of the crop in the form of dividend aristocrats. These companies have a track record of increasing dividend payouts annually for at least 25 consecutive years.

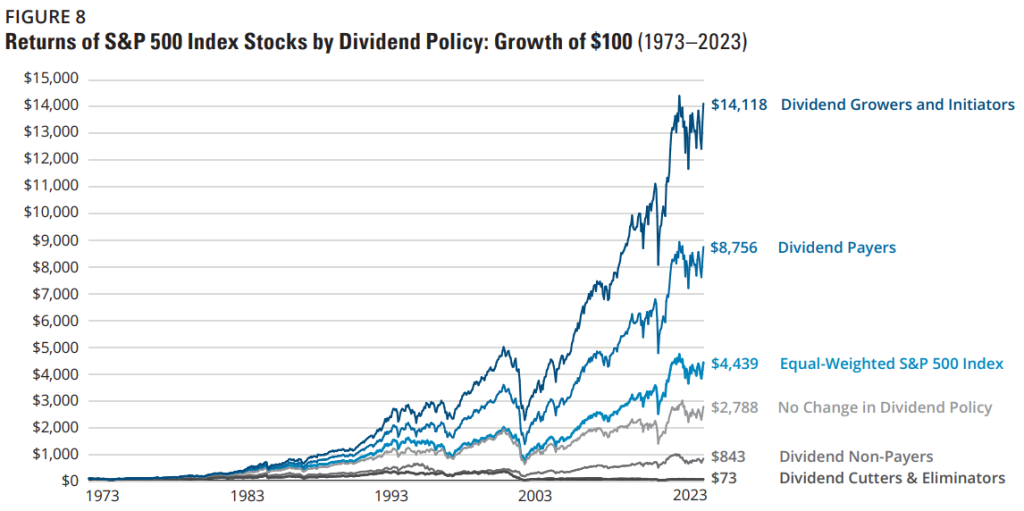

In other words, dividend growers and payers typically have lower volatility and higher returns compared to companies that either don’t pay or cut dividends. Between 1973 and 2023, both dividend growers/initiators and payers outperformed the S&P 500 index in average annual returns.

However, it bears noting that the dividend contribution to total stock returns is on a downward trajectory. After the dot-com bubble popped in March 2000, the market disruption yielded negative S&P 500 returns for the 2000s decade.

This eventually leveled up the dividend contribution to the previous decade’s level. Yet, it is likely that growth stocks, this time carried on the back of the AI hype, will once again de-emphasize dividend stocks in the 2020s decade.

This tells us that investors lean on growth assets over reliable, low-risk dividend investing. Even so, such investing still resides within the US stock market as an expression of the US hegemony.

Namely, the Federal Reserve acts as the de facto world central bank. Utilizing USD as a global reserve currency, the Fed can monetize excess spending as foreign governments buy US debt. In turn, the ever-increasing Fed balance sheet trickles into the US stock market with record-breaking market caps that overshadow entire nations.

This fortifying dynamic exempts the world of blockchain assets, but they could eventually build up into a blockchain mirror of the S&P 500.

Gains in Tokenized Assets Too Good to Pass?

All signals point to the incoming Trump admin as the friendliest for blockchain assets. Not only did Trump attend the Bitcoin 2024 conference in Miami, but Trump’s pick for new Securities and Exchange Commission Chair, Paul Atkins, has been noted as a crypto advocate.

And as Bitcoin still tests the $100k range, the total crypto market cap reached $3.77 trillion, having outpaced the November 2021 peak of $2.98 trillion. The problem is that the crypto market has a coin dilution problem. There are currently over 16,000 tokens to be tracked for performance.

This tracking is impractical, and crypto investors have difficulty pinpointing which ones have staying liquidity power. Ultimately, this benefits Bitcoin as the first-mover coin. Bitcoin is also the beneficiary of its proof-of-work algorithm that ties Bitcoin to a broader ecosystem of energy and hardware assets miners use.

At the same time, it remains the case that Bitcoin’s large market cap makes it difficult to move its price. This is not the problem of altcoins, especially memecoins, as their market caps can balloon overnight. Conversely, 2024 has been the year of memecoin narrative dominance.

Real-world asset (RWA) tokens follow closely behind memecoins, with AI tokens ranking third in performance. Yet, despite memecoin gains, it is exceedingly difficult to reliably time their tops (market exits) and bottoms (market entries). After all, these assets derive value from social media buzz instead of earnings found in dividend stocks.

In other words, memecoin investing is too fickle and should be avoided.

In the face of token inflation and memecoin uncertainty, the crypto market is seeing a return to the familiarity of older altcoins, such as Cardano (ADA), XRP (XRP), Avalanche (AVAX), Chainlink (LINK), Immutable (IMX), Polkadot (DOT), Algorand (ALGO), and others.

Over the last month, it is notable that utility/infrastructure/finance coins gained more persistent investor interest, pointing to a more viable tokenized ecosystem long-term. Accordingly, crypto investors would be wise to visit this token performance visualization to determine which tokens (over a longer timeframe) are likely to have greater staying power.

The Bottom Line

Ultimately, investing operates on a gambling spectrum: dividend investing sits at the lowest risk-end, while memecoins occupy the highest risk-end.

In the middle ground, Bitcoin paved the door for tokenized assets that are likely to have greater staying power and utility. In the current altcoin season, the most optimal approach would be to invest in these ecosystems – DeFi, L1, blockchain gaming, AI, – rather than fleeting memecoins.

But after exiting their tops, it would be prudent to invest some of the altcoin gains into dividend stocks for the low-risk, long-term exposure.

As inflation continues to erode USD in perpetuity, which hedge tactic is your favorite? Let us know in the comments below.