Betterment Launches 4 Crypto Thematic Portfolios for its 730,000+ Customers

Betterment is opening its digital investment doors to cryptocurrencies. Holding $33.8 billion for its +730k customers, Betterment will offer four types of crypto portfolios, adapted for each market segment. With over 21k cryptocurrencies in circulation since Bitcoin launched in 2009, Betterment’s thematic approach to crypto investing is a much-needed streamlining. The Robo advisor had acquired passive crypto investing startup Makara earlier in the year.

Betterment’s New Crypto Portfolios

As last month’s Gemini report showed, crypto adoption still needs to be bolstered by educational resources. After all, more people (40%) count on them as opposed to friends’ recommendations (22%). This is why Betterment is segmenting its crypto offering entry into four pieces, picking protocols with the highest TVL traction for each.

Betterment will accompany crypto portfolios with regular educational content. Given Betterment’s history of streamlining investments, this was to be expected.

All four crypto portfolios hold 2% weight as hard cash in USD. This makes sense as the Dollar Strength Index (DXY) rose by +17.83% this year.

The Universe portfolio consists of 25 cryptocurrencies with Bitcoin (BTC) holding 34.6% weight and Ethereum (ETH) at 15.88%. The rest are under five percent. Universe takes small chunks out of every crypto market – DeFi, metaverse, payments, oracle networks, Ethereum alternatives, and layer 2 scalability solutions. Even the king of memecoins Dogecoin (DOGE) is represented at 3.81%.

The Sustainable portfolio consists of 23 cryptocurrencies, removing ones that are based on the more energy-intensive proof-of-work consensus. As such, Ethereum is weighted at 41.95%. Otherwise, it is similar to the Universe portfolio, in addition to more DeFi and metaverse tokens, while lacking any memecoins.

The Metaverse portfolio consists of 23 cryptocurrencies. Although it is metaverse-oriented, it is not much different than the Sustainable one in terms of token selection. Bitcoin is weighing at 30.76% and Ethereum at 14.12%. Metaverse games and platforms are the same, but with 2x greater weight. These are Axie Infinity (AXS), Decentraland (MANA), The Sandbox (SAND), and Enjin (ENJ). Dogecoin is back with a slightly lesser weight at 3.38%.

The last portfolio is Decentralized Finance (DeFi) at 24 cryptocurrencies. Bitcoin is represented at 28.56% and Ethereum at 13.11%. Lending and exchange dApps are prioritized, led by Uniswap (UNI) at 6.97% allocation. The rest are under five percent: Aave (AAVE), Compound (COMP), Yearn.Finance (YFI) and others.

Interestingly, none of the Betterment portfolios hold the Monero (XMR) privacy coin. Instead, all but the Sustainable portfolio hold the alternative Zcash (ZEC). This coin makes financial privacy optional, in addition to having lower transaction fees. However, ZEC has a -69% lower market cap and has underperformed XMR by -23%, year-to-date.

Join our Telegram group and never miss a breaking digital asset story.

Is it the Right Time to Gain Crypto Exposure?

During the last week, even more heavyweights onboarded the crypto train. Google announced BTC payments for its Cloud services, using Coinbase. McDonald’s opened BTC payments for its chain in Lugano, Switzerland, while Namibia’s central bank approved BTC for retailers.

Concurrently, the SEC once again rejected a spot-trading ETF. This time, it was the Wisdom Tree Bitcoin (BTC) Trust ETF. The SEC cited insufficient investor protection against market manipulation. This is odd considering that the agency approved six futures-based BTC ETFs which don’t own any Bitcoin, with 25 still waiting for the SEC approval.

In other words, these SEC-approved ETFs rely on price speculation, often triggering downward pressures on the BTC spot-trading market. In light of this, Betterment’s crypto offering is a major step forward in simplifying and mainstreaming cryptos for retailers.

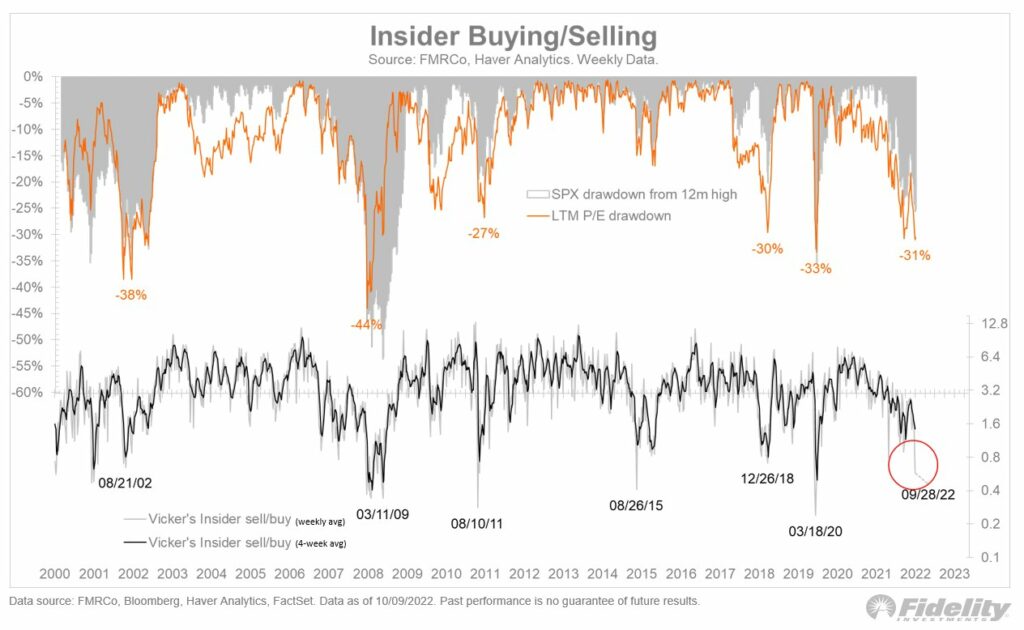

With that said, Betterment still recommends 5% crypto exposure, with either portfolio, out of total investable assets. Whether it is time to go in now is a different story. According to Fidelity, insider stock purchases at a discount are on the rise again.

This indicates that they think the market bottom is in, so the asset prices will likely only go up. Of course, this depends on the next Consumer Price Index (CPI) report on October 13th. If it is higher than estimated (8.1%), then the Fed would have cause for another interest rate hike. In turn, this is likely to trigger more market selloffs.

Presently, the market is following a worse-than-average track with S&P 500 down -25% year-to-date. Likewise, Betterment’s portfolios are heavily weighted with Bitcoin and Ethereum, which are down at -60% (BTC) and –65% (ETH). With that said, if the strong dollar continues to exert negative pressure on foreign central banks, developing nations could see BTC as a safe haven from the faltering fiat system.

Do you think we will see new market bottoms before the year ends? Let us know in the comments below.