Robinhood Insider: White House, Sequoia Capital Made ‘The’ Call to Robinhood

By now, everyone is well aware of the situation with Robinhood and GameStop (GME). In short (no pun intended), a group of hedge funds—namely Melvin Capital and Citron Capital—started to short sell GameStop’s stock, GME. In essence, these funds bet that GME would decrease in value.

Robinhood’s Class Action Lawsuit Explained

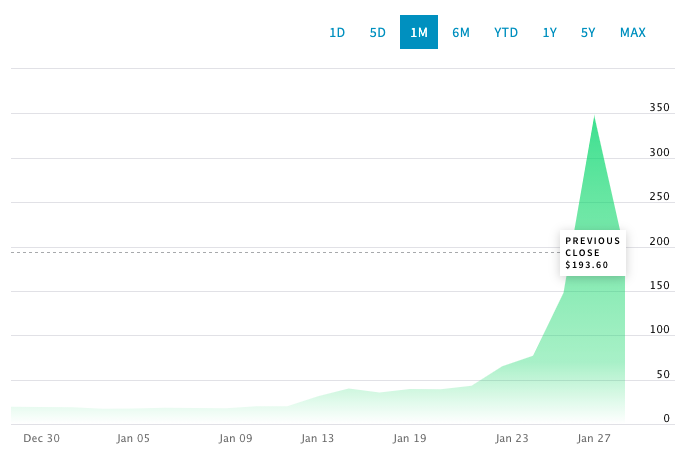

A group of retail traders, who are largely known from Reddit’s r/wallstreetbets community—and for their diamond hands—moved to counter such short selling. Their activity caused GME to skyrocket, as hedge funds, the so-called experts of Wall Street, lost upwards of $5 billion.

Wall Street was taken by storm. This sort of activity had never been seen, and signaled a new era of finance ushered in by FinTech platforms like Robinhood. As a pioneer of commission-free stock trading, Robinhood’s schtick was the democratization of finance—by cutting unnecessary stock trading fees and bringing the stock market to the masses.

Back in 2016, Robinhood tweeted it’s montra:

Well, that hasn’t aged well. Yesterday, Robinhood halted support for certain securities, including the closing positions of $AAL, $AMC, $BB, $BBY, $CTRM, $EXPR, $GME, $KOSS, $NAKD, $NOK, $SNDL, $TR, and $TRVG. It is anticipated that some of these securities—even if to a limited degree—will be available once again via Robinhood on January 29th.

Many were outraged by the restriction, as traders were essentially robbed. Dave Portnoy, founder of Barstool Sports, tweeted “I won’t rest till the people responsible for today are behind bars.” He also tweeted,

Now, #deleterobinhood has become a trending hashtag on twitter, with the likes of US Congressmen getting in on the action. Traders are now turning to other platforms, such as Webull’s stock app and Stash’s investing app.

After all the activity, people are left wondering—why did Robinhood restrict trading on GME? Who told Robinhood to stop supporting GME? Was external influence involved?

Information from Robinhood Insider on GME Restrictions

While the credibility of the individual is unknown, an alleged Robinhood insider has taken to Reddit to provide information on the reasoning behind the restriction.

The user wrote,

As Reddit is a pseudonymous forum, it is unknown whether the claim bears legitimacy.

What we know for certain however, is that a class action lawsuit has now surfaced.

According to the lawsuit,

“Robinhood purposefully, willfully, and knowingly removing the stock “GME” from its trading platform in the midst of an unprecedented stock rise thereby deprived retail investors of the ability to invest in the open-market and manipulating the open-market.”

The lawsuit was filed on January 28th, taking hardly any time at all. The results of the filing however, will likely take much longer.

Disclosure: Tim Fries has no positions in any of the stocks mentioned, and has no plans to initiate any positions within the 72 hours following the publishing of this article. This article expresses the opinions of Tim Fries. Tokenist Media LLC has no position in any of the stocks mentioned, and does not plan to initiate any positions within 72 hours of the publishing of this article. Please consult our website policy for more information.