3 Top Stocks to Buy Before 2021 Arrives

One benefit of having the Federal Reserve as a sovereign monetary entity is that it will serve as a stabilizing force no matter who POTUS is. Although the unemployment rate is still high and further lockdowns wreak havoc on the economy, it could have been much worse without the Fed’s intervention in March. As a result, the stock market may serve as the vanguard for economic recovery.

Top Stocks as 2020 Comes to an End

The numbers already show it: The NASDAQ Composite index plummeted by 2,400 points between February and March. In November, it recovered to 12,094 points, which means it’s up by 36% for the year. Likewise, the S&P 500 is up by 13%.

Those are above average highs. In reality, this means that the most powerful corporations got even richer. Overall and counting, founders and CEOs of Walmart, Nike, Amazon, Google, Apple, Facebook, and Microsoft collectively gained $243 billion during the pandemic. However, for millions of people to continue to avail themselves of their services, much will depend on the bipartisan stimulus package that is still being hashed out.

Although some investors believe it would be wise to portion some of your investment portfolio into Bitcoin, the end of 2020 is a good time to review stocks that show continued resilience and growth potential.

1. Pinterest (NASDAQ:PINS)

What is the position of Pinterest in a space dominated by giants like Facebook’s Instagram or Twitter? As social platforms go, Pinterest has a unique operating model. No matter your interest, you can discover it, expand upon it, and organize these ideas represented by Pins.

Naturally, Pinterest gains an income stream via promoted Pins, which drive traffic and sales by linking back to websites. Given Pinterest’s recent e-commerce upgrade, and the expected retail increase this holiday by 4.4%, the platform is poised to benefit all parties involved: shoppers, marketers, and investors.

Moreover, Facebook continues to drive away users by the heavy use of censorship across the political spectrum. Much like Twitter, it is becoming an unstable platform, which Pinterest is ready to exploit and not become itself. After all, Pinterest is not about social networking per se, but focusing on the positive aspects of self-development.

For the holiday season, Q4 2020, Pinterest is aiming for a 60% revenue growth, based on the massive growth of its user base during the pandemic. However, do keep in mind that Pinterest’s executive branch was recently sued for “toxic work culture”.

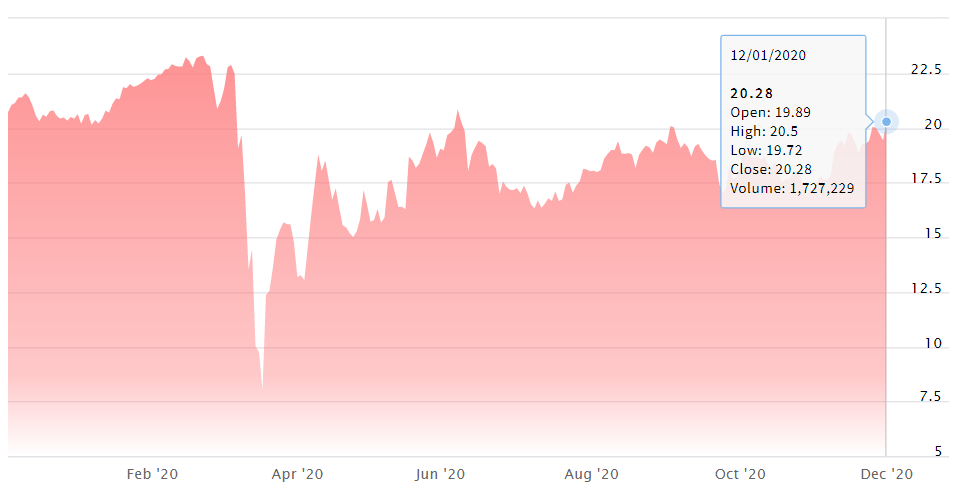

2. CareTrust REIT (NASDAQ:CTRE)

At the best of times, the nursing home sector is often fraught with abuse, as occupants are left at the mercy of nursing employees. The pandemic made things much worse by reducing revenues due to safety conditions for both the residents and staff. However, CareTrust continues to pull through with outstanding results.

For Q3 2020, CareTrust’s EBITDA ratio held at 3.1, in line with the sector’s biggest players such as Ventas and Welltower. It also reported a 99% collection of monthly rents despite the pandemic. Correspondingly, CareTrust achieved a strong balance sheet and upheld its $0.25 quarterly dividend.

Rising above the crisis makes CareTrust ready to tackle the future in which 80 million Americans will be older than 65 by 2040. This will create a huge nursing housing and care market for decades to come. Likewise, CareTrust’s dividend, currently at 5%, will likely yield much more if you are prepared for the long growth.

3. Sea Limited (NASDAQ:SE)

Despite the total domination of Amazon in e-commerce, delivery and publishing, there is still room for niche e-commerce platforms to grow. Sea Limited started as a gaming company with its freemium Free Fire, but it expanded its e-commerce reach into seven sea-oriented regions: Singapore, Taiwan, Indonesia, Vietnam, Thailand, the Philippines, and Malaysia. These nations represent a massive market for Sea Limited to fulfill with its network.

The doubling of orders and gross merchandise volume for Q4 already proved that to be the case. Accompanying this growing e-commerce network, Sea Limited is also spearheading its own SeaMoney digital payment system. During the last six months, its payment traffic doubled as well. To give you an idea of its growing user pool – Garena Free Fire – achieved a 100+ million peak of daily active users in Q2 2020.

You can already see where this is going. As Sea habituates customers to use its payment system, it makes them more likely to partake in their in-game offers. In turn, they are habituated to the entire ecosystem of gaming, e-commerce, and payment. Even giants like Amazon had a more humble start.

Are you more interested in Bitcoin/DeFi yield farming or in the traditional stock market? Let us know in the comments below.

Disclosure: Tim Fries has no positions in any of the stocks mentioned, and has no plans to initiate any positions within the 72 hours following the publishing of this article. This article expresses the opinions of Tim Fries. Tokenist Media LLC has no position in any of the stocks mentioned, and does not plan to initiate any positions within 72 hours of the publishing of this article. Please consult our website policy for more information.